Mastering Trade Spend and Promotion Planning: A Guide for Emerging CPG Brands Navigating Retail and Distributor Partnerships

In the fast-paced and ever-evolving world of Consumer Packaged Goods (CPG), understanding trade spend and promotional planning is the key to driving success for your brand. With countless variables like product category, competition, and the specifics of your retailer partnerships, it can feel overwhelming. As experts in the field, we at TrewUp have firsthand experience with these challenges, and our platform is designed to not only navigate these complexities but also provide you with actual data, enabling more precise planning and promotion execution. But don't worry, we're here to break down the ABCs of trade spend and promotions planning for you and provide practical principles that can guide your promotional strategies.

Getting to Know Your Retailer: A Recipe for Success

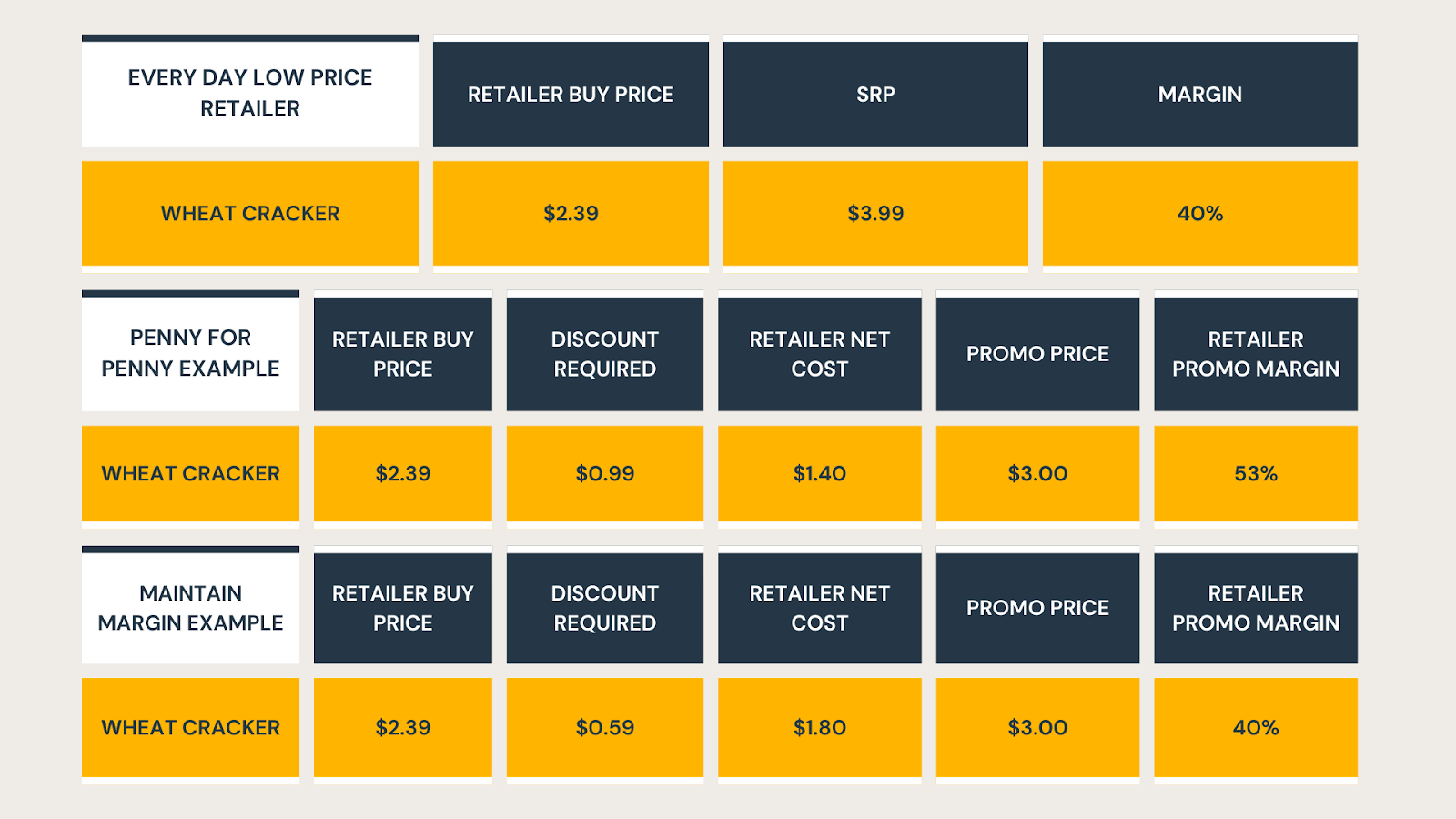

To effectively plan your promotions, it's crucial to have a deep understanding of your customers and the retailers you work with. By aligning your promotional tactics with the retailer's strategy, you can ensure a win-win scenario. The first step is understanding the retailer's margin requirements for your category. In order to successfully create a promotional plan you’ll need to know what their margin will be for your everyday retail price. In the example below, we’ve used a 40% margin expectation from the retailer.

Next, let’s set the stage with an example. We’ll use a cracker company. They’ve built their pricing (after factoring in retailer margin and distributor margin) to achieve a regular retail price of $3.99. They’ve built in a 20% trade spend budget in their P&L, which is $0.38 per unit based on the below pricing. Here’s the price build from the brands list price to the retailer shelf price.

Cracker brands Delivered List Price (per unit): $1.92

Distributor Price to Retailer: $2.39 (20% margin - as example)

Retailer Shelf Price: $3.99 (40% margin - as example)

* A quick tip on calculating margin: [(retail price - cost of product) / retail price] x 100

Now, let's take a closer look at some common retailer strategies:

Every Day Low Price (EDLP) Retailer: With these retailers, having the most affordable prices in the market is one of their primary strategies. They don't want you to hold back trade spend dollars to promote. They want you to sharpen your pencil and provide a discount on every unit sold. In this scenario, you would provide a discount on every unit sold. This could be 10% - 20% trade spend. I'd recommend giving less than 20% to save room for other fees and marketing opportunities, like advertising.

High/Low Retailer: In this scenario, having the lowest price in the market is not as important as showing their shoppers that they offer great promotions. Therefore, your everyday price isn't reduced with a discount, but you'll plan to promote with TPR's (temporary price reductions). We'll talk about frequency and depth shortly, but this discount might be 15% - 30%. From the cracker example above, they might promote at 2 for $6.

Hybrid Retailer: Now we're talking about a blend of strategies. You offer an everyday low price to reach a certain price point, all while keeping room to surprise customers with occasional promotions.

Understanding the retailer's strategy is essential for success in their store. For instance, offering an everyday low price in a high/low store might limit your ability to offer promotions, as customers there are accustomed to grabbing deals. On the other hand, failing to provide your lowest price at an EDLP retailer might create an issue with your buyer when they compare their price on your item to a competitive retailer. So, knowing your retailer's game plan is a game-changer!

Navigating Retailer Promotions and Margins: Finding the Right Balance

Understanding how retailers calculate their promotions and margins is essential for effective trade promotion planning. Understanding, planning and negotiating appropriately can save you significant money. Here are a couple of methods to consider:

“Penny for Penny” Promotional calculation: In this type of promotion, the retailer requires that you fund the entire promotion “penny for penny”. Meaning if you want the TPR tag to show $1.00 off you’re paying for the full $1.00 off.

"Maintain Margin" Promotional calculation: With this approach, the retailer expects to maintain their margin as a %. As you’ll see in the example below, both you as the brand and the retailer contribute to the promotion, ensuring the retailer's margin percent remains the same. It's a collaborative effort that benefits both parties by reaching deeper discounts at the shelf.

Let’s see these scenarios played out using our Cracker example:

As you can see, the difference is significant. The “maintain margin” example requires less discount to reach the desired promotional price point. To further emphasize the difference, in the example above, if you sold 10,000 units on promotion the difference is $4,000.

Retailers have their expectations, which you’ll need to follow if you’d like to participate in their programs. The key is understanding what the expectation is, negotiate if possible, and plan accordingly. The final point here, is if you’re working with a retailer that requires penny for penny, you’ll want to reduce either your frequency, depth or both. For example, rather than hitting a $2/5 promoted price point, you might need to target a $2/6.

Promotional Frequency and Depth: Striking the Right Balance

Finding the sweet spot for promotional frequency is vital, especially when dealing with high/low and hybrid retailers. Going overboard with promotions doesn’t just erode your margins, it can also devalue your product, as customers get used to snagging it at discounted prices. So, how do you strike the right balance?

Traditionally, 4 four-week promotions (16 weeks annually) have been the industry standard. However, if your retail partner allows for shorter promotions, there's potential for great success running two-week promotions. The key is to think in terms of weeks throughout the year. With a four-week cycle, your product is on promotion for a total of 16 weeks per year and might be promoted at 25% off. But with two-week promotions, you promote less (12 weeks annually), while diving deeper into discounts (35-40% off) for shorter bursts, increasing product velocity. Below are visual examples:

Cracking the Retailer Discount Code

Different retailers use different methods to calculate discounts. Let's dive into a couple of the common types:

"Scans" Promotions: In these promotions, the discount is taken directly at the point of sale, benefiting customers. Discounts are typically measured in dollar amounts based on what is sold at the register and then directly invoiced to your brand. It's a win-win that offers clear visibility into the impact of promotions.

Manufacturer Charge Backs (MCBs): Retailers often prefer this method, where the discount is provided directly to them when they purchase your product through a distributor. During the promotion period, the retailer passes the discount along to consumers. However, keep in mind that retailers may not sell all the discounted products they purchased, allowing them to revert to the everyday price after the promotion ends. It’s also worth noting that the % discount for this method is usually calculated off the distributor's wholesale price.

Off Invoice Discounts (OI): We typically see these with distributors. The discount/promotion is reflected on the invoice and the distributor will pay you the net amount after the OI discount. These operate similar to MCBs in that they’re taken off every case sold to the distributor. We won’t drill into this today, but ensuring that you’re planning for these is important to knowing your true trade rate.

If you have the ability to choose the discount type for your brand, scan promotions provide greater transparency. But be prepared, as MCBs are often the preferred and sometimes the only discount type accepted by retailers.

Costs of Running a Promotion - Fees!

Let's talk about the nitty-gritty of running a promotion - the costs involved. We've already discussed the discounts you offer during a Temporary Price Reduction (TPR) at the retail level. But it's crucial to understand the financial implications beyond just the direct discount.

Imagine this scenario: You offer a $1 discount per unit sold, and let's say you sell 1,000 units. Simple math tells us that you incur a cost of $1,000 for that promotion. But wait, there's more to consider.

Retailers often impose a TPR fee, which can vary significantly. It could be a few hundred dollars or even a few thousand dollars. This fee is outlined in your agreement with the retailer, and if you have a broker handling your contracts, they can clarify this cost for you.

And that's not all - distributors also charge a fee for handling the deductions from your TPR. Let's say your promotion costs $1,000, and the retailer adds an extra $200 fee. This $1,200 deduction is passed on to the distributor, who then imposes a handling fee. The fee structure can vary, ranging from a percentage of the total deduction (usually around 3-10%) to a flat rate (approximately $50-$150), depending on the distributor's practices. For the sake of this scenario, let’s play out the scenario of $150 distributor handling fee. Therefore, the total cost of this promotion is actually $1,350, which is $350 more than just the promotional redemption.

So, what does all this mean for you? It means proper financial planning is crucial when executing promotions. Your promotional plan should take into account not only the direct costs associated with discounts to customers but also these additional fees and deductions. Failing to account for these costs may result in a negative return on investment (ROI) for your promotional activities.

While it would be great to avoid these costs whenever possible, it's important to understand their potential impact. By having a clear understanding of these fees and deductions, you can ensure accurate promotion planning and prevent excessive costs that could eat into your profitability.

So, when you're crunching the numbers for your promotions, make sure to factor in these costs and fees. It's all about being financially savvy and ensuring that your promotional activities are not only impactful but also sustainable for your bottom line.

True-up Your Promotional Plans

Post-promotional analysis is also critical to a brand's success. Especially, in the early days as you’re continuously iterating through trial and error. Think of promotions in the same way. Circling back to assess how much you spent, was it successful, and what would you change or iterate against going forward. Maybe you want to move from a 4 week promotion of “$1.00 off reaching $3.99” to a 2 week promotion reaching 2/$7. You’ll provide a deeper discount, but for a shorter period of time. However, you can learn from these programs if you don’t review the outcome. I’m not suggesting you’ll be able to review every single program you run, but I am suggesting you pick a retailer or two and try a few different promoted price points, frequencies, etc.

Of course, having actual’s is critical to assessing the effectiveness of these promotions. By actuals, we mean how many units were sold on promotion vs. your forecast, and how much did you spend on fees vs. forecast. Of course, this is where TrewUp comes in. Deductions provide this level of detail, but extracting the information from a 100 page PDF document is nearly impossible. Furthermore, even register scan data lacks distributor and retailer fees. Not to say you couldn’t brute force it, but getting the data handed to you vs. spending hours on manual work typically leaves you burnt out before you even get to the post-promotion analysis part.

Regardless, the key is learning through trial and error with a few different retailers and promotional tactics to find the sweet spot. From there, understand the retailers expectations, the fees along the supply chain, and plan for success.

Final Thoughts

As you journey into the world of trade spend and promotional planning, remember that it's not just about crunching numbers. It's about understanding your retail partners, taking creative leaps in your promotional strategies, and learning from each campaign to continually enhance your approach. The process may seem complex, but think of it as an exciting exploration that grows alongside your brand. And remember, you're not alone in this journey. We at TrewUp are more than just a platform, we're your partner, eager to navigate these waters with you, providing the necessary insights and tools every step of the way. Here's to our shared growth and success in the exciting world of CPG!